Freddie Mac 1105 free printable template

Show details

MULTIFAMILY PROPERTY CONDITION FORM Section I: Summary Mortgage, consultant and property information Freddie Mac loan number Seller/Service name Seller/Service number of apt. Buildings Number of stories

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form 1105

Edit your freddie mac property condition report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mac 1105 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

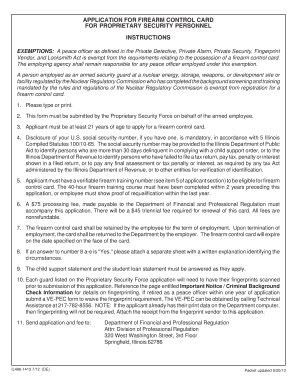

Editing formulaire 1105 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form 90 freddie mac. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fannie mae site pdffiller com site blog pdffiller com form

How to fill out Freddie Mac 1105

01

Obtain a copy of the Freddie Mac Form 1105 from the official Freddie Mac website or your loan officer.

02

Read the instructions provided with the form carefully to understand the requirements.

03

Fill in the borrower’s information in the designated fields at the top of the form.

04

Provide details about the property, including its address and type (single-family home, condo, etc.).

05

Complete the financial information sections, including income, assets, and liabilities.

06

Review the disclosures and certifications sections to ensure all necessary acknowledgments are made.

07

Sign and date the form where indicated once all information is accurately entered.

08

Submit the completed form along with your mortgage application to your lender.

Who needs Freddie Mac 1105?

01

Homebuyers applying for a mortgage loan through Freddie Mac.

02

Lenders offering loans backed by Freddie Mac.

03

Real estate professionals involved in transactions where Freddie Mac financing is utilized.

04

Financial institutions needing to document loan details for compliance purposes.

Fill

form

: Try Risk Free

People Also Ask about

What are the requirements for a Freddie Mac loan?

There are several requirements: The owner/investor of your loan has to be Fannie Mae or Freddie Mac. This is for low-income borrowers. You need to have a DTI ratio of 65% or less. You have to be current on your mortgage. This must be a 1-unit primary residence. Your loan has to be a certain age.

What properties are ineligible for Freddie Mac?

Freddie Mac does not purchase Mortgages secured by: Vacant land, undeveloped land or land development properties. Properties used primarily for agriculture or farming.

What are Fannie Mae and Freddie Mac guidelines?

Fannie Mae and Freddie Mac Requirements Debt-to-income (DTI) ratio as high as 43% or 50% in some cases. Credit score of at least 640 or 620 in some cases. Down payment as low as 3% No recent major derogatory credit factors, such as foreclosure, short sale, bankruptcy or repossession.

Where does Freddie Mac get its money?

Freddie Mac's investors include but are not limited to central and commercial banks, pension funds, insurance companies, and securities dealers from around the world.

How does Freddie Mac get more funds to purchase loans from primary lenders?

By packaging mortgages into MBS and guaranteeing the timely payment of principal and interest on the underlying mortgages, Fannie Mae and Freddie Mac attract to the secondary mortgage market investors who might not otherwise invest in mortgages, thereby expanding the pool of funds available for housing.

What is the primary source of funds for financing mortgages?

Savings and Loan AssociationsEdit. While savings and loan associations (S&Ls) are not the largest financial intermediary in terms of total assets, they are the most important source of funds in terms of dollars made available for financing real estate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit Freddie Mac 1105 in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your Freddie Mac 1105, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an electronic signature for the Freddie Mac 1105 in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your Freddie Mac 1105 in minutes.

How can I fill out Freddie Mac 1105 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your Freddie Mac 1105 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is Freddie Mac 1105?

Freddie Mac 1105 is a specific form used by lenders to report certain loan-related information to Freddie Mac, which is a government-sponsored enterprise that provides liquidity to the mortgage market.

Who is required to file Freddie Mac 1105?

Lenders who sell or service mortgage loans to Freddie Mac are required to file Freddie Mac 1105 to report specific information about the loans.

How to fill out Freddie Mac 1105?

To fill out Freddie Mac 1105, lenders must provide loan identification information, borrower details, loan type, and loan amount among other required data fields. The form should be completed accurately and submitted according to Freddie Mac’s guidelines.

What is the purpose of Freddie Mac 1105?

The purpose of Freddie Mac 1105 is to ensure that accurate and complete loan information is reported to Freddie Mac for monitoring and compliance purposes, which helps maintain the integrity of the mortgage market.

What information must be reported on Freddie Mac 1105?

The information that must be reported on Freddie Mac 1105 includes loan identification number, borrower name, address, loan amount, loan term, interest rate, and other relevant details pertaining to the loan.

Fill out your Freddie Mac 1105 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Freddie Mac 1105 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.